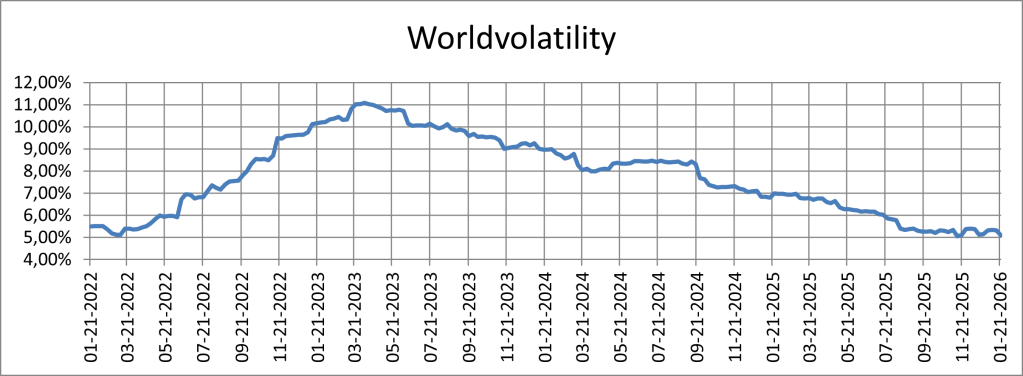

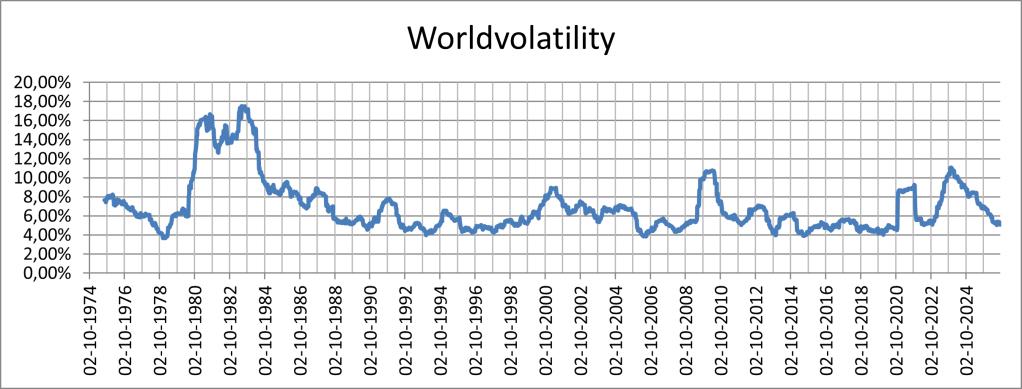

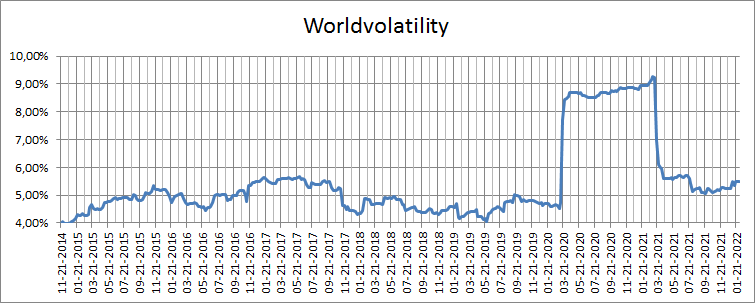

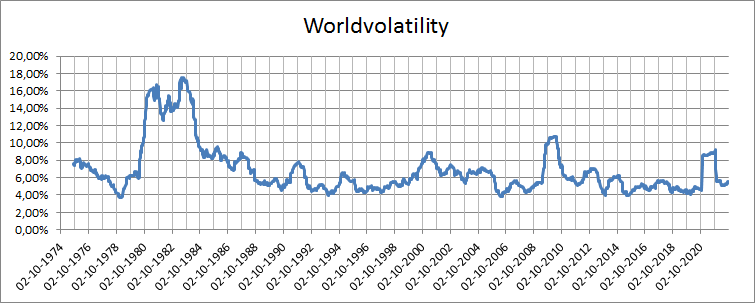

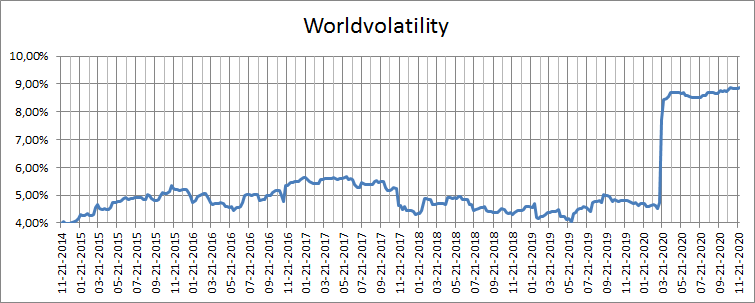

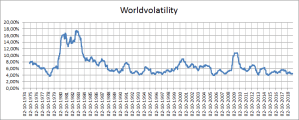

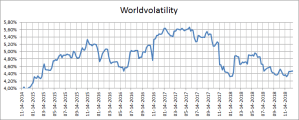

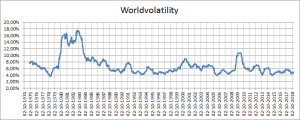

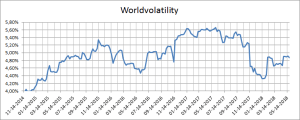

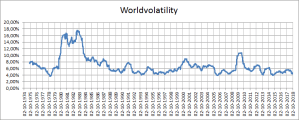

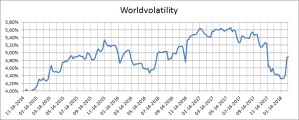

After Davos geopolitical issues are in focus. Treasuries, Gold, and Equity markets show pockets of relatively high volatility. The riskparityweighted portfolio (Worldvolatility) does not show any signs of extreme volatility. This is mostly due to the different asset types diversifying each other giving a Worldvolatility of just 5,10%. The asset markets in total are quite calm waters although the narrative (especially geopolitical narrative) would suggest otherwise.